The smart Trick of Transaction Advisory Services That Nobody is Discussing

Table of ContentsWhat Does Transaction Advisory Services Mean?The Best Strategy To Use For Transaction Advisory ServicesThe Definitive Guide for Transaction Advisory ServicesRumored Buzz on Transaction Advisory ServicesNot known Facts About Transaction Advisory Services

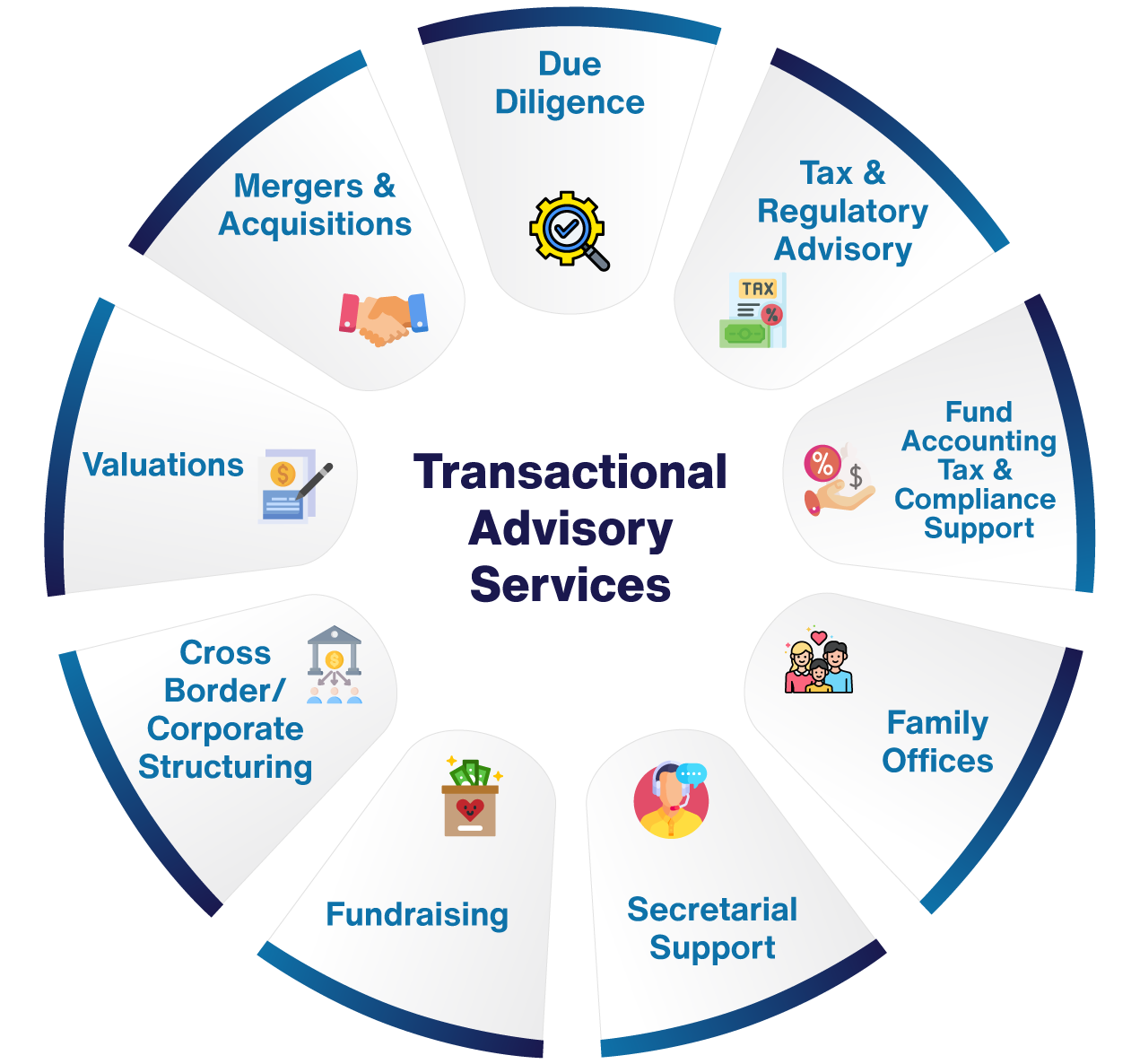

This action makes certain the company looks its ideal to potential customers. Getting the service's worth right is important for an effective sale.Deal experts action in to assist by obtaining all the required details arranged, answering concerns from customers, and organizing sees to business's place. This constructs depend on with buyers and keeps the sale relocating along. Obtaining the most effective terms is essential. Transaction advisors use their experience to assist company proprietors handle difficult arrangements, fulfill buyer expectations, and framework bargains that match the owner's goals.

Fulfilling lawful policies is vital in any type of service sale. They help business proprietors in preparing for their following steps, whether it's retired life, starting a new endeavor, or handling their newfound riches.

Purchase advisors bring a riches of experience and expertise, ensuring that every element of the sale is taken care of expertly. Via strategic prep work, evaluation, and settlement, TAS helps company owner accomplish the greatest feasible sale rate. By ensuring legal and regulative compliance and managing due persistance alongside other bargain group participants, transaction experts reduce possible dangers and liabilities.

The 6-Second Trick For Transaction Advisory Services

By comparison, Large 4 TS teams: Work with (e.g., when a potential buyer is carrying out due diligence, or when a bargain is closing and the buyer needs to incorporate the firm and re-value the vendor's Annual report). Are with costs that are not connected to the bargain shutting successfully. Earn fees per engagement someplace in the, which is much less than what investment banks make even on "tiny bargains" (yet the collection chance is also a lot greater).

, but they'll concentrate much more on accountancy and assessment and much less on subjects like LBO modeling., and "accounting professional only" subjects like trial balances and just how to stroll via occasions utilizing debits and debts rather than economic declaration modifications.

Transaction Advisory Services Things To Know Before You Get This

Experts in the TS/ FDD groups may also interview administration about every little thing above, and they'll write a thorough report with their findings at the end of the process.

The hierarchy in Purchase Providers varies a little bit from the ones in investment financial and private equity careers, and the general form appears like this: The entry-level duty, where you do a great deal of information and financial analysis (2 years for a promotion from below). The following degree up; similar work, but you get the more intriguing little bits (3 browse around these guys years for a promo).

Particularly, it's tough to obtain advertised beyond the Supervisor level since couple of individuals leave the task at that phase, and you require to begin showing evidence of your capacity to generate income to breakthrough. Allow's begin with the hours and way of living because those are less complicated to explain:. There are occasional late evenings and weekend break job, however nothing like the frantic nature of investment banking.

There are cost-of-living adjustments, so expect reduced settlement if you remain in a less expensive place click resources outside major financial facilities. For all placements except Companion, the base income consists of the mass of the total compensation; the year-end benefit may be a max of 30% of your base wage. Frequently, the very best means this website to boost your incomes is to change to a different firm and negotiate for a higher wage and perk

About Transaction Advisory Services

At this phase, you must just remain and make a run for a Partner-level role. If you want to leave, perhaps move to a client and do their appraisals and due diligence in-house.

The primary issue is that due to the fact that: You typically need to join one more Huge 4 group, such as audit, and job there for a couple of years and then move right into TS, job there for a couple of years and then move right into IB. And there's still no guarantee of winning this IB duty due to the fact that it relies on your area, customers, and the working with market at the time.

Longer-term, there is additionally some threat of and since examining a business's historic monetary info is not exactly rocket scientific research. Yes, people will constantly need to be entailed, however with advanced innovation, reduced head counts could possibly sustain client interactions. That said, the Purchase Providers team beats audit in regards to pay, work, and exit chances.

If you liked this short article, you may be interested in reading.

Some Known Facts About Transaction Advisory Services.

Establish advanced monetary frameworks that help in determining the actual market price of a firm. Offer advisory work in connection to organization assessment to assist in negotiating and prices structures. Explain the most suitable form of the deal and the kind of factor to consider to use (cash, supply, earn out, and others).

Carry out assimilation preparation to establish the process, system, and business modifications that might be needed after the deal. Establish guidelines for incorporating departments, modern technologies, and business processes.

Examine the possible customer base, industry verticals, and sales cycle. The operational due diligence supplies important understandings into the performance of the firm to be gotten concerning threat assessment and value production.